Official WeChat

Building Materials Industry Prosperity Index (MPI) for August 2025

I. Building Materials Industry Prosperity Index for August

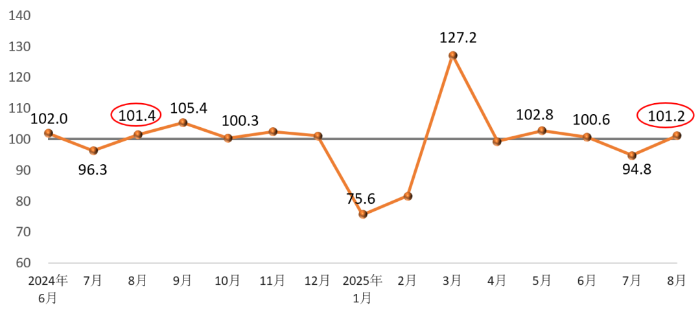

In August 2025, the Building Materials Industry Prosperity Index stood at 101.2 points, above the critical threshold and within the prosperity range. This represents an increase of 6.4 points compared to July but remains 0.2 points lower than the same period last year, indicating a month-on-month recovery in the building materials industry.

Monthly Building Materials Industry Prosperity Index

On the supply side, in August, the price index for the building materials industry was below the critical threshold, while the production index exceeded it. Specifically:

- The Building Materials Industry Price Index was 99.0 points, down 0.7 points from the previous month.

- The Building Materials Industry Production Index was 102.2 points, up 7.1 points from the previous month.

Overall, prices of building materials products continued to experience slight declines and remained in a low-level fluctuation trend, while production activity improved compared to the previous month.

On the demand side, in August:

- The Building Materials Investment Demand Index was 101.0 points, above the critical threshold and up 7.1 points from the previous month, reflecting a low-level recovery in investment-related markets.

- The Building Materials Industrial Consumption Index was 102.5 points, up 4.8 points from the previous month, indicating a rebound in demand from manufacturing sectors that utilize building materials products.

- The Building Materials International Trade Index was 98.3 points, down 3.2 points from the previous month and below the critical threshold, signaling a decline in the value of foreign trade for building materials compared to the previous month.

Overall, investment demand and industrial consumption demand recovered in August, while international trade demand experienced a pullback.

II. Analysis and Early Warning of MPI Influencing Factors

Recovery in Building Materials Production

In August, as climatic factors such as high temperatures eased, demand in construction and related manufacturing sectors showed signs of recovery, leading to accelerated production in the building materials industry compared to July. With the exception of the clay and sand mining and architectural technical glass industries, production indices for all other sectors were within the prosperity range.

Slight Decline in Building Materials Prices

In August, among the building materials sub-sectors, product prices increased month-on-month in only three industries: cement, thermal insulation materials, and non-metallic mining and processing—three fewer than in July. Product prices decreased month-on-month in sectors such as concrete and cement products, wall materials, waterproof materials, lightweight building materials, lime and gypsum, clay and sand mining, construction stone, architectural technical glass, mineral fibers and composite materials, architectural sanitary ceramics, and non-metallic minerals. Factory prices for products in three industries—clay and sand mining, construction stone processing, and mineral fibers and products—maintained year-on-year growth. Overall, building materials prices continued their trend of low-level fluctuations.

Weak Market Demand Requires Caution in Assessing Changes in Market Expectations

According to data from the National Bureau of Statistics, from January to July, national fixed-asset investment grew by 1.6% year-on-year, down 1.2 percentage points from the previous month. Specifically, fixed-asset investment in construction and installation engineering decreased by 0.8% year-on-year. The growth rates or production volumes of products such as automobiles, solar batteries, and electronic appliances have slowed or declined. Demand in the building materials market remains relatively weak.

Recently, relevant State Council meetings emphasized the continued role of macro-adjustment policies, such as urban renewal and renovation, to stabilize market expectations and consolidate the trend of halting declines and stabilizing the real estate market. However, given the ongoing significant imbalance between supply and demand in the building materials market, industry enterprises must continue to monitor and cautiously assess market dynamics, rationally plan production, and remain vigilant to potential risks.